This high growth stocks screener tutorial will have you finding your own growth stocks in no time. The best high growth stocks tend to also outperform the market. High growth stocks have a tendency to go much higher than many people expect. This stock screener is quick and easy to setup.

I will show 2 versions of this high growth stock screener; one for Traders, and a more balanced, safer one for Investors.

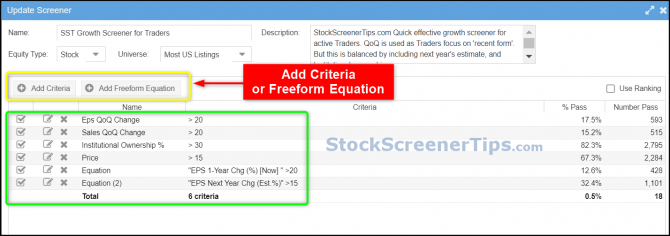

For this high growth stock screener we used Stock Rover as it has over 650 Fundamental metrics to use in our scans.

Read the full Stock Rover Review.

High Growth Stocks Screener For Traders.

As Traders usually have a shorter holding period and trade more frequently, the first part of the stock screen will produce a higher number of candidates. This will be greatly reduced in the second part for Investors.

Growth stocks have higher earnings than average performing stocks. This is also reflected in their EPS ratio or Earnings per Share. However, EPS can be manipulated, for example by stock buy-backs. To avoid this, we include sales growth in the screen, to ensure the growth is based on business performance, and not manipulation of EPS.

Some stock screeners may use the term revenue rather than sales, but both are the same thing.

Growth Stock Screener Criteria

The high growth stocks screener criteria for Traders is as follows:

2) EPS growth quarter over quarter = over 20%.

3) Sales/revenue growth quarter over quarter = over 20%.

4) EPS Next Year change (Estimate %) (forecast) = over 15%

5) Institutional Ownership = over 30%.

6) Price is over $15

A few notes on the above screener criteria.

1) I have used 20% for actual figures, but 15% for the forecast for next year, as I don’t want to miss out on good stocks due to bad forecasting.

2) Institutional ownership shows these high growth stocks are not only on the radar of institutions, but they like them enough to put their money behind them. This is such a great filter to have, because we are taking advantage of the knowledge and research resources of Institutional Traders. Secondly, we need Institutional money to move the stock price.

I like to keep the institutional ownership to 30%, as by the time the ownership is higher, so is the stock price.

Setting up the above stock screener criteria into a stock screener is easy.

We will Use Stock Rover for this example, as it has over 650 fundamental metrics to choose from.

All of the following screenshots can be enlarged by clicking on them.

Right click ‘Screeners’ in the menu tab to create a new stock screener.

In the next window just add the criteria listed above and you have the high growth screener for Traders.

This stock screen has reduced the number of stocks from over 7,000 to just 17.

You can see the stocks found above. (Note: this is NOT a recommendation to trade, but for educational purposes only.)

High Growth Stocks Screener For Investors.

Investors have a longer-term outlook compared to traders, and also usually require more ‘checks and balances’ than traders. So for investors the following additional criteria can be added.

Growth Stock Screener Criteria For Investors

The high growth stocks screener criteria for Investors is as follows:

2) EPS growth quarter over quarter = over 20%.

3) Sales/revenue growth quarter over quarter = over 20%.

4) EPS Next Year change (Estimate %) (forecast) = over 15%

5) Institutional Ownership = over 30%.

6) Price is over $15

7) EPS growth 3-year avg (%) = over 15%

8) Sales growth 3-year avg (%) = over 15%

Some Investors like to look at the past 5 years EPS and Sales growth. From my experience, I find this eliminates too many good stocks, so I have compromised and used a 3-year average look back period. Choose what you feel comfortable using. Stock Rover has data up to 10-years in it’s Premium Plus plan.

In addition, long term Investors also like to use a 5 Year EPS Growth Estimate. But I don’t believe in long-term forecasts. If you want to use this, use a rate over 15% to avoid missing out on good stocks. Again, it is available in Stock Rover. I have used the same EPS Next Year change (Estimate %) as in the first screen, as I feel the short term is more predictable.

Once again, inputting the above criteria in a stock screener is easy.

The increased stock screener criteria for Investors gives more safety checks but this also reduces the amount of stocks found.

As I mentioned, investors require more assurances as they will be holding stocks for longer periods, and may not check on their stocks every week. For this, we have added longer term filters of proven past performance of the stock. We have added criteria for the past 3 years of earnings and sales growth of over 15%, (increase to 5 years if you want). This shows consistency.

I can understand the need for this by Investors, but I don’t think Traders should be waiting 5 years for a stock to prove itself. But remember, the risk profile of Traders and Investors are completely different. Always use your own judgement, and what is right for your risk profile.

In terms of forecasting, I don’t believe in long-term forecasting. In this case, I’m referring to the ‘ 5 Year EPS Growth Estimate’ filter. So many things can change over 5 years, change in management, new competition, recession etc.

I have included the ‘EPS growth next year’ filter, as a one-year forecast is more reasonable.

I believe people use these longer-term forecasts because they are trying to attain certainty in an area where there is none. Trading/investing is about probabilities; there are no certainties in speculation.

Also, as we are dealing with earnings and sales data, we get new information every quarter during earnings season. This real data will give us a truer picture, quarter by quarter, mapping out the destination of the stock price.

Importing Stock Screeners

The people at Stock Rover have been kind enough to add my growth stock screeners to their Library. You can now import my stock screeners when you subscribe to a Stock Rover Premium Plus plan.

Importing the stock screeners is easy, and the screenshot below will clearly explain the process.

1) Go to the Library. This is where all the Stock Rover stock screeners are stored.

2) Select ‘Screeners’ and search for the screener types you want.

My screeners are called:

a) SST Growth Screener for Traders

b) SST Growth Screener for Investors

3) Select the required screeners

4) Click the import button to complete the process.

This will import the screeners into your default screener folder.

It really is that easy.

Best Growth Stocks To Buy

Remember, the stock screening process is only the first step. You need to do further research on each stock before deciding on the best growth stocks to buy. Respect your hard earned money, always complete the research process before risking your money.

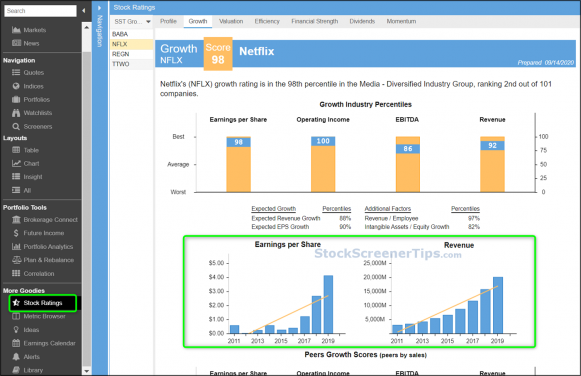

Luckily Stock Rover is also the best fundamental analysis research tool, as well as a stock screener. I’ll briefly cover some of the research possible for one of the qualifiers from our stock screen, Netflix.

In the screenshot above, we have the ‘Insight‘ view next to our stock screener results. Selecting a stock will show a vast amount of detail for the stock. Apart from an in-depth summary, there are also tabs for visuals, news, analysts, and statements. Everything you may need can be found in one place.

With all this information available it shouldn’t be hard deciding on the best growth stocks to buy. But let’s look at more info to help us decide.

Growth Stocks With Strong Buy Ratings

The Analyst tab in the ‘Insight’ panel shows the number of Analysts who gave strong buy ratings for the growth stocks found by the stock screener. Below this, are many of the Analysts estimates, but not all are shown in the screenshot.

But wait, there’s more…

Stock Rover actually has a section in the menu called Stock Ratings. The ratings cover growth, valuation, efficiency, financial strength, and momentum. All are useful and make research easy, but the screenshot above is for the growth rating tab. We can see visually, the EPS and sales/revenue growth for the past few years. This really does make research easier.

More High Growth Stocks Screeners

Before deciding which growth screener to use, here are some more high growth stock screeners from the Stock Rover screener library.

The screenshot above only show some of the growth stock screeners. As you can see, you are spoilt for choice.

Some of the interesting growth screeners worth investigating include:

- Dividend growth stocks

- Large cap growth stocks

- Mid cap growth stocks

- O’shaughnessy cornerstone growth

- Large cap growth ETF

- Mid cap growth ETF

- Tech growth stocks

There is so much more that I haven’t covered yet, such as charts, but why not try out Stock Rover for yourself.

For International stocks try Tradingview.

You may also be interested in growth stocks that pay a dividend.