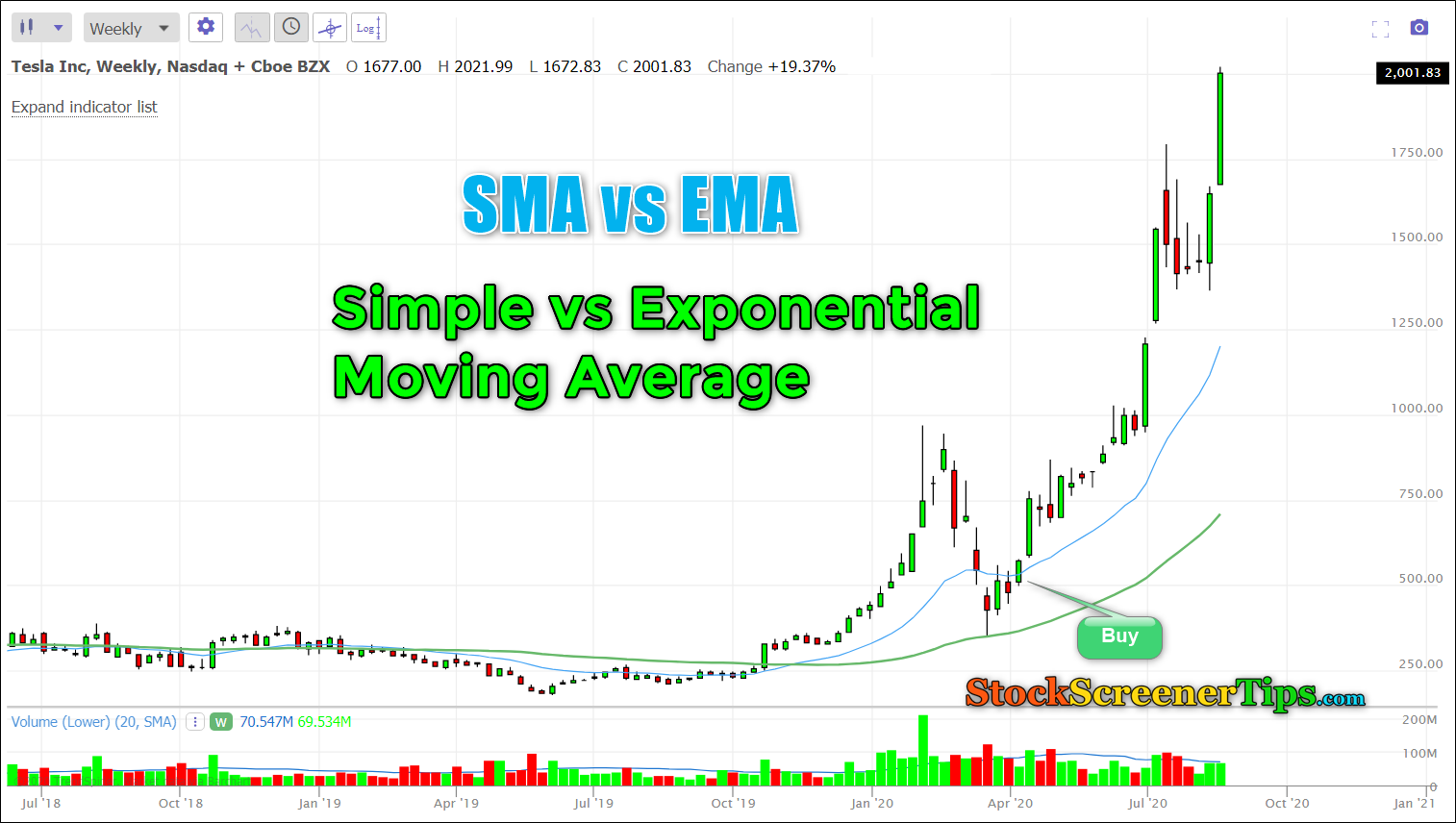

Simple vs Exponential Moving Average, which is better? Many traders struggle deciding between SMA vs EMA. It will be worth your while to spend some time researching different moving averages before you decide.

Which Moving Average Should You Use SMA or EMA?

It is important the moving average you chose reflects your trading or investing style. Traders generally prefer the EMA. Long term Investors prefer to keep it simple and just use simple moving averages.

But why not use both? I prefer EMAs for the shorter length moving averages, and SMA for the longer moving averages.

You can backtest the various combinations. It is definitely worth doing as you need to be able to trust and understand how each moving average works with price.

The video below will show you how to test the various moving average combinations, using the TrendSpider charting software.

You can see more videos at the TrendSpider University.

See the full TrendSpider Review.

Additional Info

SMA vs EMA

A simple moving average (SMA) gives equal weight to each days price.

For example, a 50 day SMA is calculated by adding the prices of the last 50 days and dividing by 50. This gives us the value for today for the 50 SMA.

An Exponential Moving Average (EMA) gives more weight to recent days prices.

You don’t need to know the (complicated) formula, as all charting software will do the calculations for you.