Sector rotation strategies have been shown to outperform buy and hold investing. Creating your own sector rotation strategy is quite easy with the right stock screener. Many people only use an ETF sector rotation strategy, which is OK but not optimal.

I focus more on stocks as the profit potential is far greater than ETFs.

Sector Rotation Strategies

We will be covering two sector rotation strategies.

- ETF sector rotation strategy

- Stock sector rotation strategy

Many busy working people only use an ETF sector rotation strategy. But with the right stock screener I will show you how you trade or invest in stocks too.

Stocks will give you a higher return than ETFs, so it’s worth putting in the little extra effort required.

But before we get started let’s cover the basics.

What is Sector Rotation?

Sector rotation has its roots in the economic cycle; where certain sectors outperformed others depending on the stage of the economic cycle.

However, this doesn’t always work out, and we are not going to guess which sectors should be outperforming at any given time.

Instead, we are going to let the market show us.

For more on sector rotation strategies see:

- https://boston.qwafafew.org/wp-content/uploads/sites/3/2020/09/A-Sector-Rotation-Strategy-that-Beats-the-MarketUpdated.pdf

- https://cdn.ihs.com/www/pdf/Sector_Rotation_model_for_US_markets.pdf

- https://etf.dws.com/en-gb/EmeaAssetDownload/Index/ad74e296-4d43-436d-acc8-fe5d2e2fc6c6/PassiveInsights-SectorAllocation-MultiFactorPerspective.pdf

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1585517

Sector Rotation ETF List

The list of sectors are shown in the table below, along with the sector ETFs I prefer to use for the sector rotation strategy.

These sectors are based on the Global Industry Classification Standard (GICS). See https://www.msci.com/gics for more details.

The GICS consists of 11 sectors, 24 industry groups, 69 industries, and 158 sub-industries.

Don’t worry; we will mainly be dealing with the 11 sectors.

| Sector | SPDR Sector ETF |

| Communication Services | XLC |

| Consumer Discretionary (consumer cyclical) | XLY |

| Consumer Staples (consumer defensive) | XLP |

| Energy | XLE |

| Financials | XLF |

| Health Care | XLV |

| Industrials | XLI |

| (basic) Materials | XLB |

| Real Estate | XLRE |

| (information) Technology | XLK |

| Utilities | XLU |

I have highlighted in red the alternative names you may see for some of the sectors.

Different stock screeners may use slightly different sector naming conventions and/or different ETFs to track them.

But as I consistently use the same sector ETFs mentioned above, across different charting software it is not an issue.

Sector Stock Screener

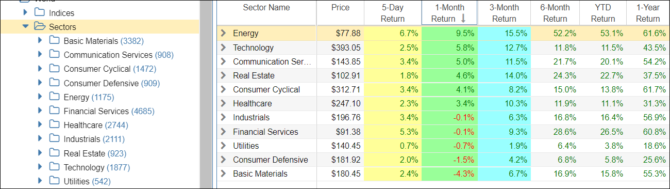

The stock screener we are going to use is Stock Rover, as it has a great layout showing the sectors and their industries.

In addition their tables and viewing options are second to none.

You can see from the screenshot above how easy it is to navigate between the different sectors and industries. Also how quickly you can sort the best performing sectors by various time-frames.

I mentioned different stock screeners may use different sector naming conventions. The example below shows the sector names used by Stock Rover.

I have spoken to Stock Rover and they use the Vanguard Sector ETFs to get the sector prices.

Feel free to use their sector list as they follow the GICS sector & industry standard.

NOTE :

i) Consumer Discretionary = consumer cyclical

ii) Consumer Staples = consumer defensive

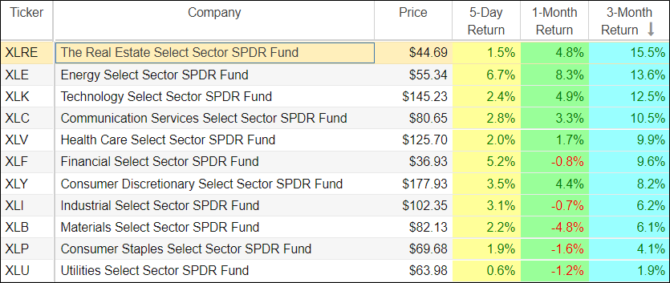

It didn’t take much work to create my own ETF sector watchlist, as Stock Rover comes with many preinstalled watchlists. One of them happens to be called ‘Sector ETFs’.

I only had to change one or two tickers to come up with the SPDR Sector ETFs watchlist below.

For the rest of this article I will use the SPDR Sector ETFs, as these are mentioned the most in the media (CNBC, Bloomberg etc) and are easily tradable.

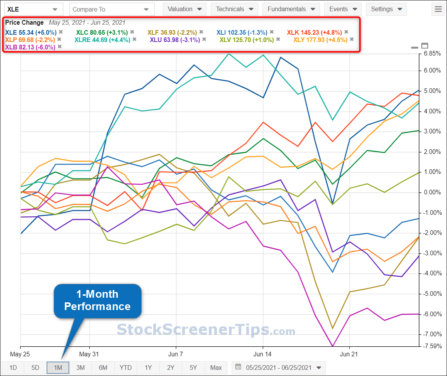

Sector Rotation Chart

Above is a chart showing the performances of the 11 SPDR sector ETFs against each other over the past 1 month.

This is useful for people who prefer a visual representation.

ETF Sector Rotation Strategy

Here is a simple ETF sector rotation strategy:

1) Check for the best 4 performing sectors over a 1-month period (for traders) or 3-month period (for Investors).

Buy the equivalent sector ETFs for the top 4, if the S&P500 is above the 200 day moving average.

The above table is sorted by the ‘3-month Return’ column.

In this case the 4 best performing sector ETFs are: XLRE XLE XLK, and XLC.

2) Then every month check the sector performances. If one of them drops out of the top 4, sell that ETF and replace it with the new top 4 entrant.

Sell all the ETFs if the S&P500 falls below the 200 day moving average.

That’s as simple as it gets.

You could of course increase the number to the top 5, as long as the 1-month return is above 4%, or the 3-month return is above 10%.

But why settle for just ETFs when with the right stock screener you can do the same with stocks with potentially much bigger gains.

Having a great stock screener and only trading ETFs, is like having a Ferrari and only driving in second gear.

But I can respect the safety argument for using ETFs, and everyone has his or her own risk profile. As long as that is the real reason, and not the extra workload of finding stocks.

Because as you will see, with a good stock screener the workload is greatly reduced.

Stock Rotation Strategy

A stock rotation strategy will be similar to the ETF strategy, except that we will be using different time periods to sort the performance. We will then run scans against the stocks in the top 4 or 5 sectors.

In the above screenshot you can see the performances of the SPDR sector ETFs I use, for the week ending Friday 25th June 2021.

The table has been sorted on the ‘1 Month Return’ or performance.

Notice Energy is the top performer.

I really like Stock Rover’s tables and the many different views available.

They have a ‘Returns’ view which I have slightly modified. I have only changed the order of the various columns, to suit my needs.

I have modified the columns so that the sectors can be sorted for percentage performance (or ‘Return’) for the following time-frames:

- 5-Day (1-week)

- 1-month

- 3-months

- 6-months

- YTD (Year-to-date)

- 1-year.

Choose what is appropriate for your trading or investing style.

A quick guide would be:

| Trader | Investor | Long-Term Investor |

| 5-Day (1-Week) | 1-Month | 3-Month |

| 1-Month | 3-Month | 6-Month |

| 3-Month | 6-Month | 1-Year |

As a trader, my main focus is the 1-month return.

But I still check for the best sector performers on the 5-day, 1-month, and 3-month.

The 5-day return is useful for early signs of a new trend or current trend weakness. It would be nice to have the 3-month positive too but not necessary for traders.

An Investor’s main focus is the 3-month return. The 1-month can be used for early signs of a new sector trend or current trend weakness. Ideally the 6-month should be positive.

A long-term investor’s main focus is the 6-month return. The 3-month return can be used for finding new trends or early signs of current trend weakness. The 1-year return must be positive for long-term investors.

When you see the same sectors appearing in all 3 chosen time-frames that is a sign of a strong trend.

Safety Measure: the S&P500 must be above the 200 day moving average. Otherwise stay out of the markets.

In the example above, the top 4 performing sectors are energy, technology, real estate, and consumer discretionary.

You can now run your favorite stock screeners/scans against all the stocks in these 4 sectors.

Note: Exit strategies for stocks will be based on your trading plan.

Outperforming The Market

The stock sector rotation strategy can be further improved to (potentially) beat the market with a simple rule change.

We only select sectors that are also outperforming the S&P 500.

If you consistently focus on the sectors (& industries) that are outperforming the market, you are putting yourself in a better position to beat the market for the year.

This is what I focus on when using a sector rotation strategy.

You can easily filter on which sectors are outperforming the market with Stock Rover. Just use their ‘Returns vs S&P 500’ view.

This is so simple yet extremely effective for those whose goal is to outperform the market.

The above screenshot was taken on the same date as the one show earlier (week ending Friday 25th June 2021). This time using the ‘Returns vs S&P 500’ view.

I like to focus on sectors that are beating the S&P 500 by at least 1.5%.

That is on whatever main focus timeframe you use the sort filter on.

( E.G. 1-month, 3-month, or 6-month return.)

In the above screenshot, that would be the top 4 sectors only (using the 1-month return filter).

Note: In this example they happen to be the same sectors as in the previous strategy. But this is not always the case.

Safety Measure: the S&P500 must be above the 200 day moving average. Otherwise stay out of the markets.

The top 4 performing sectors are energy, technology, real estate, and consumer discretionary.

You can now run your favorite stock screeners/scans against all the stocks in these 4 sectors.

Note: Exit strategies for stocks will be based on your trading plan.

Sector Rotation Chart Vs S&P 500

Again, the information can be shown visually for those who prefer it in chart form.

Above is a comparison chart showing the performance of the 11 sectors against the S&P 500. The 1-month tab is selected in this case.

Before we get to the stock screener section, I quickly want to cover Industries.

Sectors And Industries

I mentioned earlier that the Global Industry Classification Standard (GICS) consists of 11 sectors, 24 industry groups, 69 industries, and 158 sub-industries.

I also said “Don’t worry; we will mainly be dealing with the 11 sectors”.

This is true as you have seen from the previous sector rotation strategies.

Once you know the qualifying sectors, just run your stock screens against the stocks in those sectors.

But for those of you who want to take it to the next level, you can also look at the Industries within each sector.

Let’s have a look at the top qualifying sector, energy.

Above is a screenshot of the various industries in the energy sector. Notice the layout with my column modifications.

By selecting the energy sector, the industries within the sector will be shown, sorted on their 1-month return or performance.

Oil & Gas E&P is the highest monthly performing industry at 13.1%. This is a higher performance than the sector itself.

If we select an Industry, the stocks within that Industry will be shown.

Above, we have selected the top performing industry within the energy sector; Oil & Gas E&P.

Note: Stock rover shows 550 stocks in this industry as they also cover Canadian stocks and OTC stocks. When we run a screener against the major US listings only, this is reduced to just 47 stocks.

The screenshot shows the stocks for the industry, sorted by 1-month percentage change. But you could also sort by weekly or daily change.

Notice this is another table view I modified for stocks, as I like to see the daily percentage change for stocks.

Manually Scanning Charts

I know many people like to go through the qualifying sector stocks manually too, over the weekend (like me). The following example will help reduce the workload.

In the above screenshot, we can see the technology sector and its Industries.

Notice that not all the industries have a positive 1-month return.

If you were strictly following the sector rotation strategy for ‘Outperforming the Market’ rules, you could ignore all the industries below Semiconductors’.

(Their 1-month return was below 1.5 %.)

This is a huge saving in time if you are looking at charts manually.

By going through the top performing sectors and their industries, the best performing stocks can quickly be found.

Manually looking at stock charts is a nice discipline to practice over the weekend.

But there is no need to manually go through all the stocks, as we can use our stock screener.

Running Sector Stock Screeners

With a good stock screener like Stock Rover, you can quickly screen all the stocks in the top performing sectors.

Stock Rover comes with many stock screeners preinstalled. They have even been kind enough to add a few of mine which we will use here.

Read about my High Growth Stocks Screener.

To import them into your Stock Rover account just follow the instructions below.

From the screenshot above:

1) Go to the Library. This is where all the Stock Rover stock screeners are stored.

2) Select ‘Screeners’ and search for the screener types you want.

My screeners are called:

a) SST Growth Screener for Traders

b) SST Growth Screener for Investors

3) Select the required screeners

4) Click the import button to complete the process.

This will import the screeners into your default screener folder.

It really is that easy.

Selecting Sectors & Industry

With a good stock screener we should be able to choose the Sectors and Industries we want to scan.

The top 4 performing sectors were:

energy, technology, real estate, and consumer discretionary (consumer cyclical).

Sector Selection

As you can see, we can choose the sectors we want any stock screener to run against. This greatly reduces the workload.

I’m only going to go through the various options available. For more detailed info on how to add the criteria see my Stock Rover Review.

Or refer to the Stock Rover excellent help section.

Sector And Industry Selection

Here we have chosen the technology industries that are showing a positive gain for the month (see previous section for ‘technology returns’ screenshot).

Note: There is also an option for Industry Groups, which is the level above Industry. But this has not been shown.

I suggest you keep it simple and just select the sectors you want. The stock screener is going to do the heavy lifting for you anyway.

So if you were using my “SST Growth Screener for Traders”, all you would need to do is add the top 4 performing sectors, via the screener ‘add criteria’ menu option.

You could do the same with any of the prebuilt stock screens in the Stock Rover library. Why not try a value or momentum stock screener.

The edge is the fact that we are focusing on sectors that are already outperforming the market.

Summary

With a sector rotation strategy, your workload is greatly reduced by only focusing on stocks in the top performing sectors.

Take this a step further by focusing on sectors that are also outperforming the S&P 500, and you greatly increase your chances of beating the market.

Add to this the ability of stock screeners to quickly scan the stocks in the remaining sectors, and the workload is reduced even more.

In fact, I feel embarrassed calling it work.

If you believe in the concept of stock rotation as a means to outperforming the market, and are looking for a great software to implement your own sector rotation strategy, you may have found it.

Give Stock Rover a try.