Microsoft Stock Buy Trade Idea:

Microsoft was an easy stock to justify buying. It is probably one of the safest stocks with plenty of cash reserves. I tweeted the message below on the 2nd April 2020.

You can see the timestamp as proof. Below is a larger version of the chart posted.

Click chart to enlarge

Microsoft (MSFT) is a solid company, and probably one of the safest stocks to own in this market climate. It has gained from ‘work at home’ lock-down, has an operating margin of 36% and ROE of 43%. Microsoft’s free cash flow is, wait for it, 40 Billion.

Microsoft stock was an easy buy at the $150 support level, from where it bounced and hasn’t looked back, yet.

Microsoft Stock Buy – Update 17th April 2020

Be aware earnings are due Apr 29, 2020 after market hours. Consensus EPS Forecast is $1.27

Microsoft has trended higher and is now heading into resistance at $180.

See the chart below.

Click chart to enlarge.

$180 will be resistance and price can pullback, but as long as $160 holds as support, the trend is still up. I suggest you hold and don’t get shaken out. If $180 is broken the next level will be $210 – $220.

Microsoft Stock Buy – Update 21st July 2020

Click chart to enlarge.

$180 did prove to be the resistance, but this was eventually broken, and MSFT has climbed steadily.

But now earnings are due after the close on Wednesday 22nd July 2020. Remember I said MSFT was a safe stock and a longer term hold. But as usual your style of trading/investing should dictate what you do as earnings approaches. I believe short term traders will take some profits here, and long term Investors will do what they do best, hold on for a bigger move.

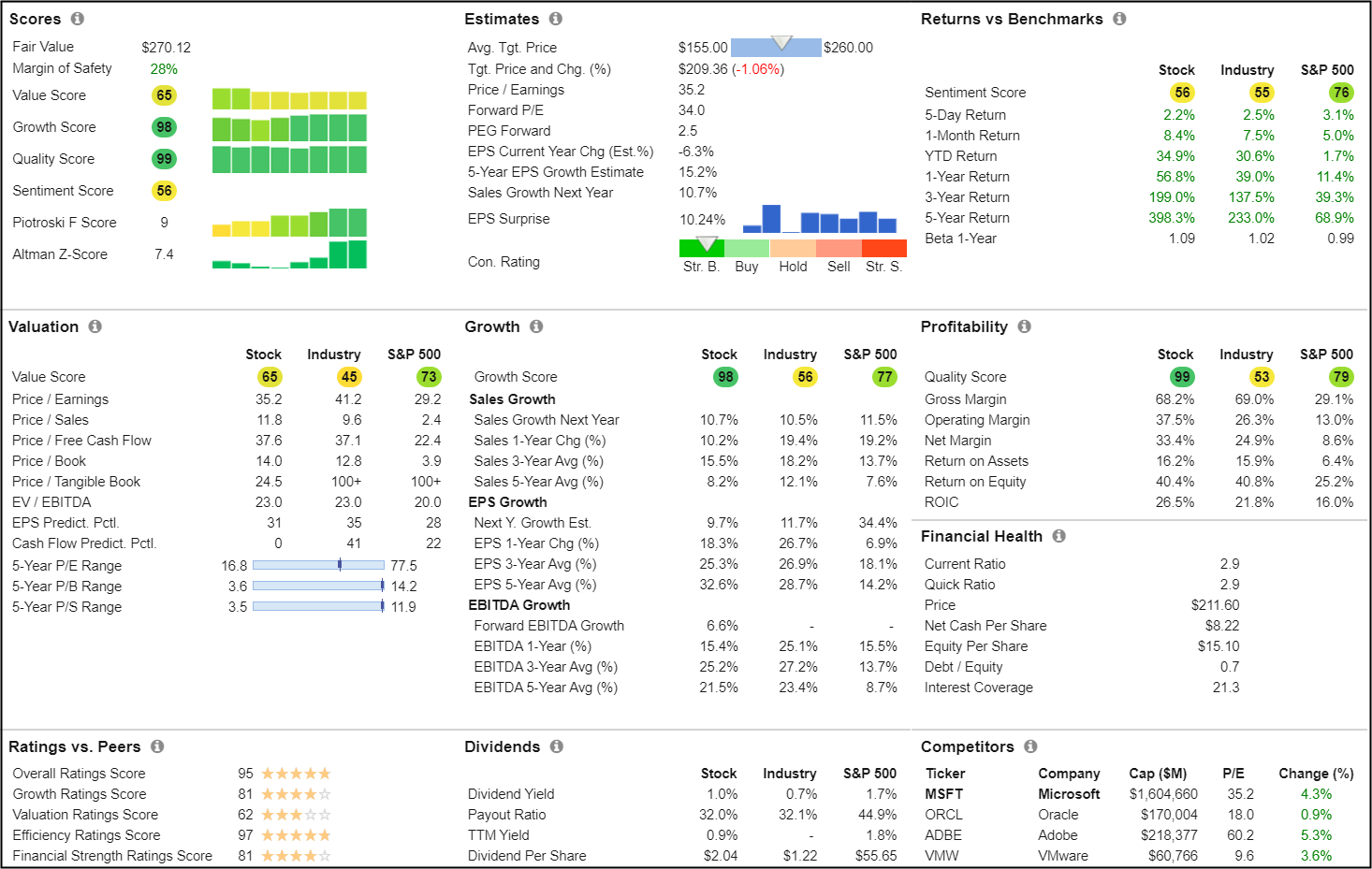

To help you decide here’s some fundamental data.

Click to enlarge.

I hope the above data helps you decide. EPS estimates are $1.37

As I have stated before, I don’t give exit signals as I have readers who trade different holding timeframes. Some are day traders, others are long term investors. So please follow your own trading plan for exits.

Stock Screeners Used

- TrendSpider Technical Analysis scanner and charting software.

I have created many personal technical scans to find stocks in play. - Trade Ideas Best Intraday high volume scanner and charts.

See how I use intraday high volume scans to find great trades early.

Read the Reviews of all the above stock screeners.

See more Trade Ideas Here

These are NOT stock tips. Please note these are just trade ideas that I may, or may not take. It just helps me to focus by writing them down. I also do not give exits as I have various readers from Day Traders to long term Investors. Each of you have to do your own research, and use your own exits that suit your style of trading.

Disclaimer: This information is for educational purposes only, and NOT a trade recommendation. these are just trade ideas that require more due diligence and research on your part. I may or may not take the trades myself.