A Premarket stock screener is an essential tool for day traders and active stock traders. The best premarket stock screeners pay for themselves in no time as they find profitable stock trades day after day.

This is one article you really need to read if you want to find a constant stream of trading opportunities.

Best Pre-Market Screener

One of the best pre-market stock screeners for day trading that I have come across is Trade Ideas.

In this article we will only be covering their premarket stock screener channel, but Trade- Ideas offers so much more. You can read the full Trade Ideas Review.

All of the following screenshots can be enlarged by clicking on them.

The screenshot above shows the Premarket channel selected with just some of the stock screeners available.

These range from premarket stocks gapping up or down, to several stock screening strategies combined in the ‘Premarket Movers’ window.

You can create your own stock scans or use the many preconfigured stock screeners included and change them.

For Info: In the Above screenshot, TSLA was gapping up because its price target was upgraded to $540 by Morgan Stanley, on top of the announcement that TSLA had gained entry into the S&P 500.

Premarket Volume Screener

There are many stock screeners included for you, but one you don’t want to miss is the ‘High Relative Volume’ screener.

Finding premarket stocks moving on high relative volume is a gold mine for day traders.

High Volume stock moves are so important that I have written a separate article you can read called How To Find High Volume Stocks. The examples in that article also use the same stock screener.

Premarket Stock Screener Examples

Here are a just a few examples I found over a few days using just Trade ideas.

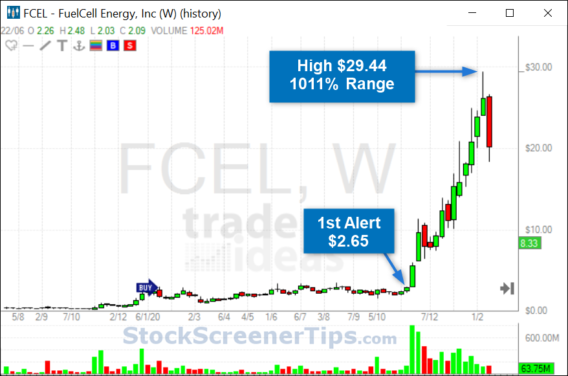

FCEL first alerted on Friday 13th November 2020, early in premarket at $2.65. This was a ‘premarket high’ alert that appeared in the ‘Premarket Movers’ strategies window.

The chart above shows the alert level and the subsequent move up the following Monday. But there was more to come…

FCEL alerted again on the premarket stock screener channel, early on Tuesday 17th November 2020. This time on the gap up stock screener window.

In the screenshot above you can see the follow-on move after the gap up. Notice the huge volume, not just on the gap up, but since the day of the first alert.

UPDATE 2021: FCEL went on to hit a high of $29.44 on the 10th Feb 2021. A trading range of 1011%.

From Premarket Hours To Market Open

Many professional day traders and active traders find their trades for the day during premarket hours, but only put their trades on when the market opens.

Tip: During Premarket hours stock prices can have wide spreads and low liquidity. Use limit orders if you must trade during premarket hours.

Continue watching your stock screener alerts during the first 30 minutes of the market open, for early signs of high volume movers.

Here is an example.

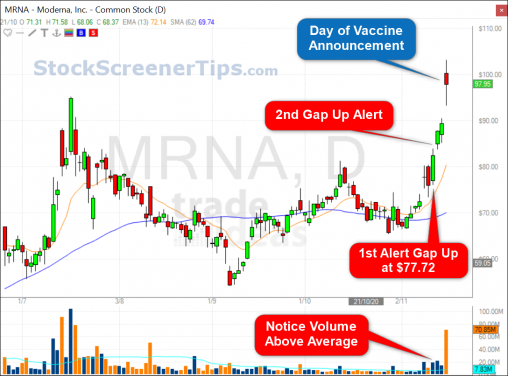

Moderna (MRNA) first alerted premarket as a gap up play on 11th November 2020 at $77.72, but I missed taking a screenshot. Later in the day it alerted again in a ‘Volume Thrust’ stock screener.

A High volume breakout move like this is usually a buy for me. But as we are talking about premarket stock screeners and I missed taking the premarket screenshot; let’s call this a missed trade.

But the high volume breakout should at least put the stock on your radar.

The following day MRNA alerted premarket as a gap up mover. See the 5 minute chart below.

The premarket gap up alert should put this stock on your watchlist. I mentioned above that you must watch the market opening price action and volume for confirmation.

You can see in the screenshot above that high volume buying came in early in the first 25-30 minutes. This suggests strongly, that the gap up will hold and this is a buy.

See the screenshot above for more confirmation. MRNA had alerted 123 times on a ‘High Volume Movers’ screener; this alerts each time the stock makes a new high on high volume. If you had this screen in front of you alerting constantly, you would not have missed this trade. Notice also the high relative volume.

The screenshot above shows what happened on the following days until Moderna announced their Vaccine was 95% effective, on Monday 16th November .

Note the price action the days before the vaccine was announced; the gap ups and the high volume. Do you get the feeling some people knew about the vaccine news and were already buying?

Stock Screeners will pick up major stock movements before you are aware of the reasons why.

This is where stock screeners are extremely useful. They may not know the reason why (news etc) but they can detect the footprints left behind by unusual price movements and volume. This is your edge. You need to be using stock screeners to find your winning trades.

If you always wait for the actual news to be revealed you will always be a step behind the Pros and paying higher prices for your stock. Learn to detect the footprints left behind by the Pros.

(The first premarket alert I noticed on MRNA was back in March 2020 around $24, using the same stock screener. You can read the write up here MRNA Stock Buy Trade.)

Stock Screeners Combined With Artificial Intelligence

Imagine if the above process could be done for you by using Artificial Intelligence?

Well you’re in luck. Trade Ideas has many AI strategies, both long and short. Their AI (Holly) will automatically find trades for you, and mark up the charts with Buy/Sell arrows.

Here is an example of the above MRNA trade, found by the AI. The chart has been automatically marked up with buy and sell arrows.

This really is a game changer in an age of High Frequency Trading, where machines can easily beat humans for speed, but not in analytic thinking.

Why not use computers and AI to do the number crunching of huge amounts of data for you. But then you use your analytic thinking and trading experience to decide which trades you actually take.

Here is another example.

In the screenshot above you start to see how AI trade signals can make your life easier in this age of information overload.

As I mentioned, you don’t blindly take the trade, but use your own judgement as an experienced trader.

This article is mainly about using premarket stock screeners to find profitable trades. But as the premarket screener by Trade Ideas has an AI plan option, it would be an injustice if I didn’t mention it.

Pre Market Penny Stock Movers

Trade Ideas has a dedicated penny stock screener channel. You can look for pre market penny stock movers using all the premarket stock screener settings or create your own.

As penny stocks are so popular, there is a separate article on the penny stock screener channel. See How To Find Good Penny Stocks.

A Premarket Stock Screener Is Your Edge

If you are a day trader or active trader, you need a real-time premarket stock screener. There is just no way around this fact.

The best Premarket Stock Screener I have found is by Trade Ideas. Combine it with their Artificial Intelligence and it becomes a very powerful trading edge.

It is definitely worth upgrading to the AI plan. Just one good trade and it will pay for itself.